For most people, investing means buying stocks, bonds and funds. But you may also be able to turn a profit on a nice bottle of Krug or Comte Liger Belair, if you know how to pick them. I’ve gathered some information on the main investors platforms and dedicated agencies. Here is what you need to know before you decide to invest in wine:

Stocks and bonds go through cycles of boom and bust, whilest collectables like fine wine deliver investment returns with little to no correlation to traditional assets. Buying wine can provide your portfolio with an excellent source of diversification. Its value is based on factors that have little relation to the performance of the economy, responding to factors such as weather patterns, harvest yields, vintage and consumer trends, supply and demand. According to Forbes, because these factors are unrelated to the overall stock market, wine investments can complement a traditional portfolio.

Advantages of Investing in Wine

For many wine investors, putting money into wine originates from a long-standing interest in wine. Most often the greatest motivation for investing in wine is to be having the wine in their possession.

Beeing passionate about wine and take the time to educate yourself thoroughly in the finer points of the assets is an important starting point when investing in wine.

Have a look at a couple of advantages of investing in wine:

- Portfolio diversification with low or no correlation with traditional asset classes

- Lower market volatility

- Fine wine can help you manage portfolio risk

- Wine can provide enhanced potential for returns

- Investing in wine may preserve value during market contractions or recessions

Risks when investing in wine

Investing in wine can entail higher costs than investing in traditional assets. Many investors don’t stop to consider the full range of costs associated with holding the physical asset, which include:

- Storage costs. Wine is delicate and must be stored in a carefully controlled environment. Depending on the size of the collection and the investor’s wallet, storage options range from a home wine refrigerator or purpose-built cellar to a professional storage facility. If you store wine at home, the cost of electricity is a consideration. Professional storage facilities charge both storage and maintenance fees.

- Insurance. Valuable physical assets must be insured against loss or damage. Depending on the value of the collection, premiums could be high.

- Holding period. A fine wine could take up to 10 years to reach its maximum value and might be subject to premature ageing . Wine isn’t a suitable investment if you have a shorter or much longer time horizon. It is important to be smart to reselling or auctioning it when its value has peaked.

How to build your portfolio?

My personal advise if you decide to start building your portfolio:

- Get professional advice and support about what and when to buy and sell.

- Buy only from certified sources, ideally from producer / winemakers.

- Make sure your storage conditions are perfect, or think of outsourcing to a temperature-controlled and humidity-regulated warehouse.

- Investing in fine wines can be a lucrative opportunity, but it can also be daunting without the right expertise.

- Pay attention to vintage. The quality of a harvest varies from year to year, with weather having the most significant impact on the grapes. A well-informed investor should be aware of the vintages that yield the best production of the wine under consideration.

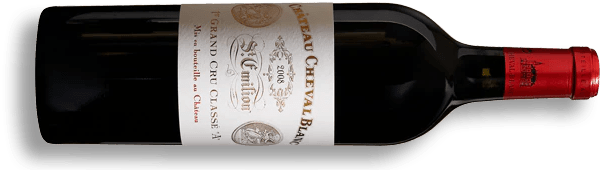

- Weigh the producer’s reputation. It has a big impact on a wine’s potential for appreciation. Many of the most investable wines come from leading producers, for example Domaine de la Romanée-Conti (DRC), Pétrus, Château Mouton Rothschild and Château Lafite Rothschild, Château Cheval Blanc, Château d’Yquem, Domaine Bonneau du Martray, Krug, Salon, Ruinart, Dom Pérignon…

- Understand a wine’s aging potential & longevity. Aging potential is critical for fine wine because some wines age better than others. Factors that can influence the potential to age well include the type of grape and level of acid and tannins. You can also look at a producer’s track record of creating wines that age well.

- Longevity varies among wines. Investment-grade wines tend to mature around 10 years after bottling, but some wines can age for extended periods, appreciating in value and quality all the while. Others will only be drinkable for a shorter period after fully mature.

- Examine scarcity and price history. Wine scarcity drives up the value of the vintages you invest in.

- Pay attention to the wine critics. Their recommendations are taken very seriously, and critic ratings can have a strong impact on a wine’s potential to appreciate. To name a few of the the most influential : Robert Parker, James Suckling and Jancis Robinson, Essi Avellan . Be sure to assess their published opinions on wines you’re considering.

How to buy wine as an investment?

Get your free wine investmente advice by contacting me

Write me / get in touch and I will be at your service to elaborate an overview of what to buy, where and at what price.

Wine vs Stock: Which Is a Better Investment?

Read more about the comparison Wine vs Stock:

Is wine a better investment than stocks?

Summing up: wine can be a very lucrative investment. But an important buyer beware: You should bear in mind that the most common wine investment indexes like Liv-ex and Sotheby’s track tens, if not hundreds, of wines, and any individual wine in the index may not exactly replicate the performance of the index itself.

So its wise to diversify and buy a variety of individual wines to avoid placing too much weight on the performance of one vintage or winemaker.

More information: How to build a portfolio for wine investment?

Sources: Livex, Forbes, Hindu, The Drinks Business, Winesearcher, UVA Today, Moneymade.